- Bangkok, 21th June 2021

In may 2020 Covid 19 was striking economies around the world like non pandemic before. Restrictions on social interaction were raised in order to prevent the spreading of the virus. This presented a great impact for insurance in both positive and negative ways, Covid-19 insurance was sold like never before, reaching millions of people in just a couple of months. However, sales on other products like life insurance, Unit link products and others, were facing some conundrum. Regulations establish that there must be a face to face interaction to conduct the sale in order to ensure a clear product understanding and avoid frauds, however the restrictions prohibited face to face interaction.

AppMan sought the opportunity to fill in this gap and worked closely with regulators in Thailand to develop a prototype for a remote communication solution that covered all requirements from the regulatory institutions.

AppMan Digital Face to Face is a unique solution that connects people in times of social distancing under a controlled and secure environment. Digital Face to Face is more than a simple videocall it is a process enhancer that simplifies the journey of not only insurance customers but any given industry with need of remote communication, data security and supporting evidence management.

Digital Face to Face can be a stand alone solution or a plug in solution with customization options. These attributes enable a fast deployment environment, as low as 2 week, for quick results harvesting. Insurers can quickly set up and deploy the solution to help their salesforce and staff perform their activities under the new normal restrictions.

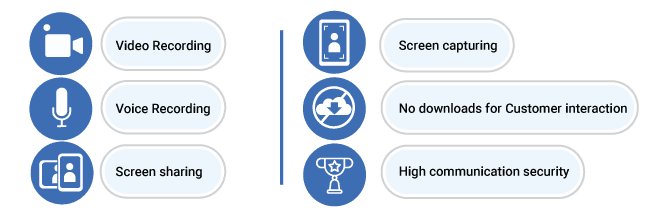

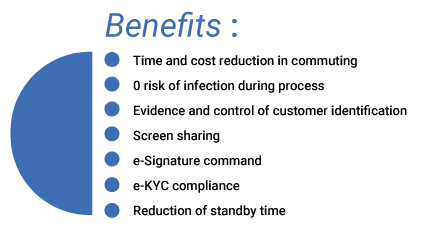

Digital Face to Face has relevant features in accordance with the current regulations. Some of the highlights of Digital Face to Face are:

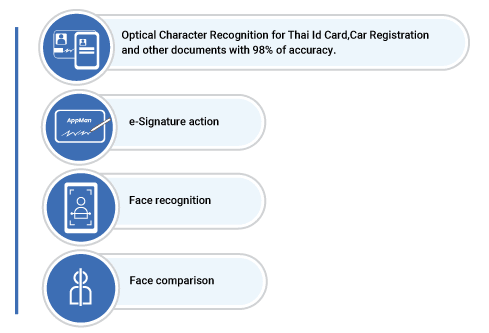

On top of the basic functionality, AppMan can embed other technologies to create a more complete solution to guarantee an effective remote process digitization. These add-ons can further improve the customers experience using technologies like:

With all of these functionalities, Digital Face to Face can enhance the remote processing for remote selling of Life and Unit Linked products, and Remote adjuster and remote surveyor between others.

Mechanics of AppMan Digital Face to Face

As mentioned before, we have developed an application that can be both stand alone or a plugin to your current system. Through the application, agents, employees and other staff can trigger communication with the customers by sending a link to open with the web browser, simplifying the user journey and being customer friendly.

This means that the customer is not required to download, set-up or install any software to their mobile devices. The only requirement is to have a camera and good connectivity to the Internet.

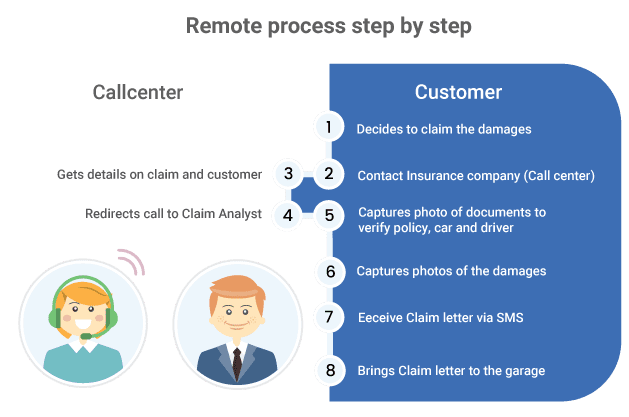

Once the communication is open agent, employee or staff can send actions, share the screen, take screenshots and more. The open communication makes it easy to guide the customer through the claims process or improve the explanation and illustration of the products intended to purchase.

Digital Face to Face for Dry Claim experience.

Dry Claims are characterized by a low urgency. These types of claims have happened in the past and are reported days or even months later. However there must be a surveyor that physically evaluates the damage and claim. This can be simplified with remote communication and the cooperation of the insured, transforming the process into a remote experience and reducing the involvement of the surveyor.

Digital Face to Face for Remote Selling.

During Pandemic a large number of insurance agents had to face the restrictions imposed by governments. Some agents were doing workarounds to collect customers information, signature and to explain the products. This situation represents a threat to companies as communication and protocols are not standardized, there are risks of fraud, data leakage and an increased risk of complaints. Besides the mentioned risks, all of these methods do not comply with regulations and can generate sanctions and further conflicts.

With AppMan Digital Face to Face, companies offer their salesforce a platform that supports remote selling. Using this technology companies can ensure a standardized and convenient experience transforming the customer journey. This solution completely comply with regulatory standards to do Digital face to face regulation from the Office of insurance committee.

Conclusion

AppMan Technology aims to simplify the experience of insurance sales and claims. Digital Face to Face solution delivers convenience for the insured during times of limited social interaction. We empower the salesforce to conduct a remote sale and control the sales journey with recorded evidence. We provide a solution so your agents are safe from potential infection risks as well as your customers.

Digital Face to Face is a process enhancer that, even if pandemic situations ease restrictions in the future, grants an alternative to digitize more processes for insurance and has great advantages.