Streamline the process of opening client accounts with APPMAN OCR.

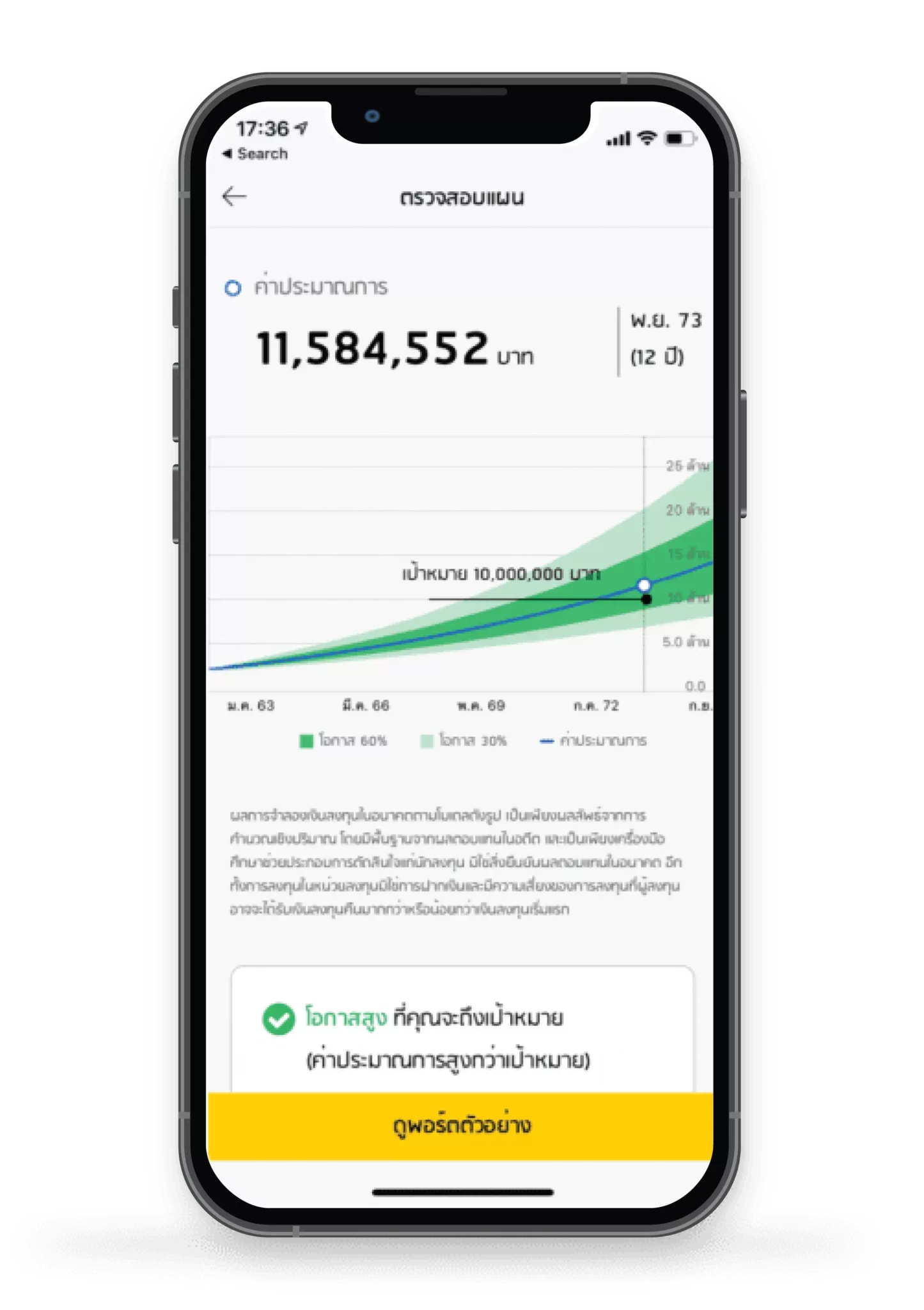

FINNOMENA is a financial technology (fintech) company based in Thailand that provides investment data analytics and asset management services. It was originally focused on developing a robo-advisory platform for individual investors. FINNOMENA expanded its services to include data analytics, investment research, and institutional asset management. The company has been growing continuously and has become the largest company of its kind in the region with more than 440,000 subscribers and over 1 billion USD in Asset under Advisement (AuA),

FINNOMENA must compete with market barriers and larger financial services competitors. To keep ahead of the competition, FINNOMENA will need to continue inventing and distinguishing itself by providing exceptional customer experiences. Due to the fact that more than a thousand accounts are created every day and there are only 7-8 temporary employees to analyze and verify the accuracy of the information, errors are likely to occur.

In addition, as a mutual fund brokerage, FINNOMENA must transfer its customers’ identification cards to partner organizations such as asset management companies while the company must manage customers’ private information. FINNOMENA must then conceal some sensitive information about the customer’s privacy, complying with PDPA regulations.

Know Your Customer guidelines are essential in this business and have gained importance in recent years. FINNOMENA sought the opportunity presented by this technology to add security measures for data protection, and data masking, and data collecting in their onboarding procedure. By using AppMan’s OCR Technologies customers can take a photo of their ID card to open an account, the technology will validate and process the data while saving a masked image of the ID Card.

FINNOMENA can perform preliminary screening of customers by the identity verification process and reduce almost 60-70% of the time to open onboarding accounts with a significant impact on the business and customer experience.