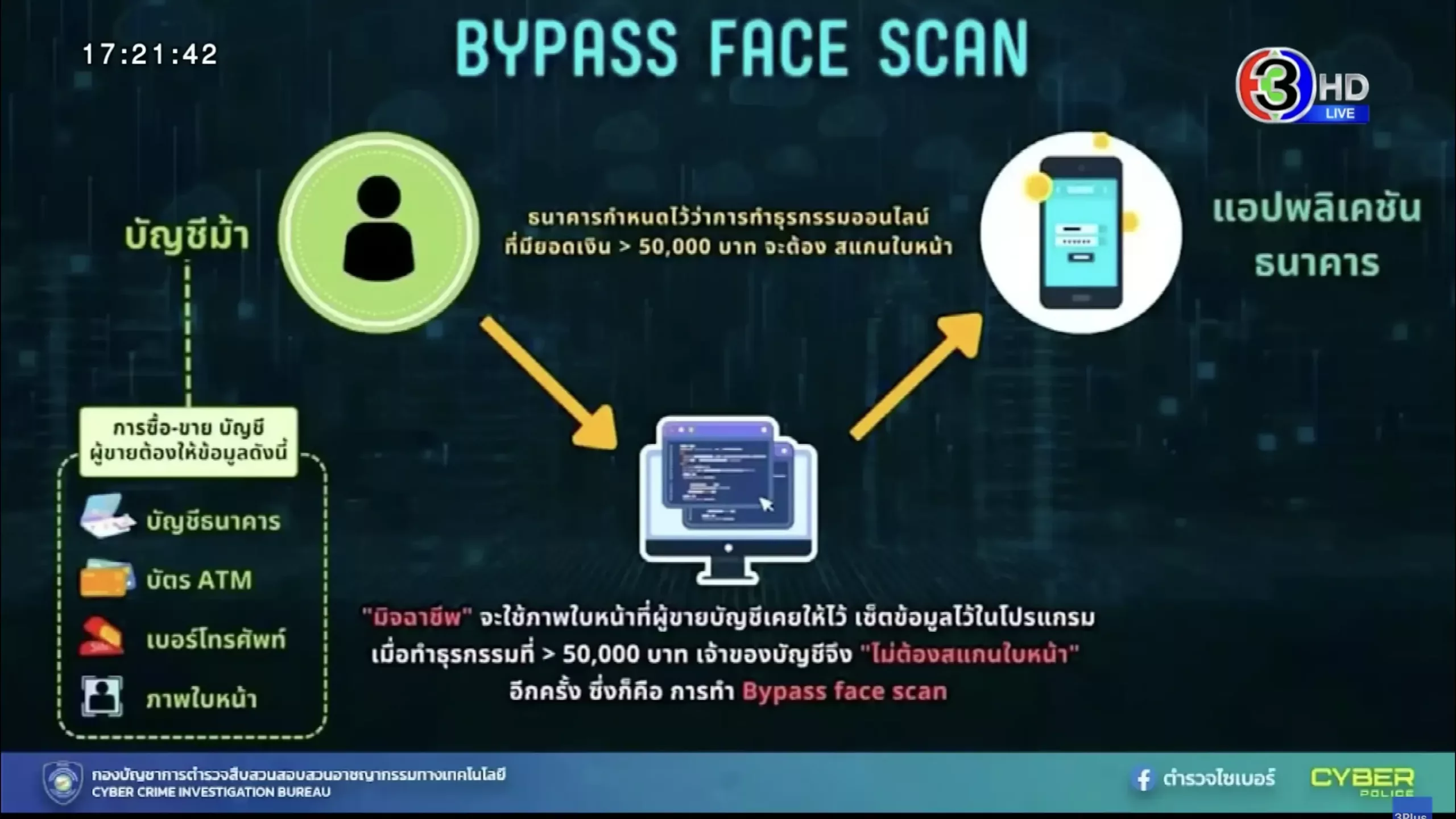

From recent news, “Cyber Police Arrest Programmer Selling API Bypass Face Scan Software to Criminals”, this program takes the account owner’s data, which is sold on the dark market, such as national ID numbers, account numbers, ATM card numbers, and facial images, to access bank accounts externally to the application. It can also circumvent the face scanning required before withdrawing funds from the account without going through the bank’s application.

The aforementioned case highlights the importance of eKYC systems, which are technologies designed to quickly and securely verify a person’s identity. An efficient eKYC system operates by scanning a user’s face and employing liveness detection to ensure that the individual is real and not using a fabricated image or AI-generated deepfake.

The operation of the BYPASS FACE SCAN program

Thank you for the image from Channel 3

Reference : https://bit.ly/4717n0w

APPMAN’s E-KYC employs Liveness and Fraud Detection technologies to verify identities through facial movement, which helps prevent the use of someone else’s facial images. It also can detect high-precision AI-generated facial manipulations.

Learn more

The use of an efficient eKYC system helps ensure smooth financial services operations.

In addition to verifying individual identities, an effective eKYC system can also read information from national ID cards and auto-fill data, which enhances the speed and accuracy of the identity verification process. The use of standard-compliant eKYC technology boosts efficiency in verifying personal identities, ensuring security and expediency in the process.

The OCR technology in the APPMAN E-KYC system can assist in the verification of fake national ID cards using effective AI to prevent fraudsters from forging ID cards before carrying out various transactions.

Learn more

In Thailand today, eKYC technology plays a significant role in enhancing the security of various transactions, from financial dealings and accessing government benefits to requesting permission to access critical data from large databases across various organizations. The use of E-KYC technology is crucial in reducing the risk of unauthorized access to personal data and preventing the misuse or unauthorized use of such information.

The future of eKYC technology in Thailand’s financial system

In the future, the adoption of E-KYC technology in situations requiring personal identity verification will play a crucial role in enhancing security and preventing privacy breaches of personal data. This is a vital part of elevating the safety and reliability of Thailand’s financial system. Additionally, it can significantly increase the speed and reduce the complexity of the personal data verification process for Thai citizens.

APPMAN E-KYC has been certified with the ISO27001 standard and CSA STAR by the British Standards Institution (BSI), which are internationally recognized benchmarks for organizations that manage and protect information assets. These standards ensure security by employing an effective management framework.